Industrial Decarbonization

Representatives of major gas pipeline companies said they are optimistic that political shifts at the federal and state levels will create opportunities for gas infrastructure expansion in New England.

New York, frenetic at the best of times, bordered on frantic when Climate Week coincided with the U.N. General Assembly meeting, writes Dej Knuckey.

Washington’s Ecology Department clarified that cap-and-invest rules that apply to CAISO’s Western Energy Imbalance Market also will cover the ISO’s Extended Day-Ahead Market when it begins operations in 2026.

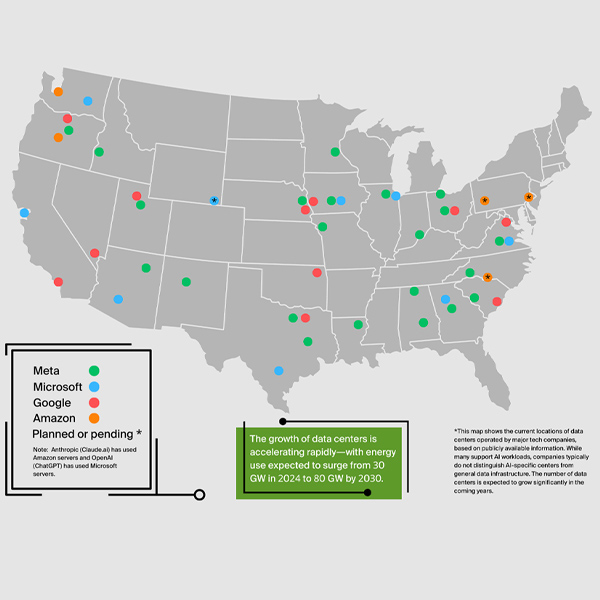

Green America launched a campaign to hold big tech to its clean energy promises as the shift to building data centers has led to higher emissions from the sector in the 2020s.

Google is reporting another sharp annual jump in electricity consumption at its data centers but says greenhouse gas emissions were lower in 2024 than 2023, by some measures.

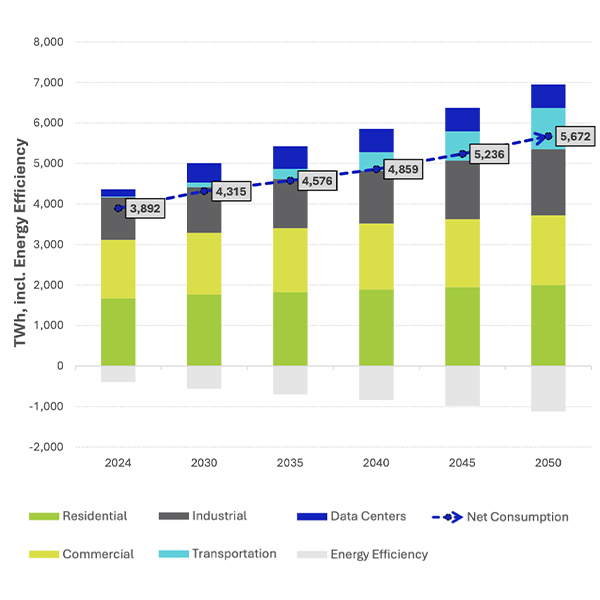

Electrical manufacturer trade group NEMA was the latest to release a forecast of electricity demand growth, which shows data centers dominating in the first decade plus, but EVs making up the most from the late 2030s onward.

Washington state has relaunched rulemaking that will pave the way for linking the state’s cap-and-trade program with the already-linked programs of California and Quebec.

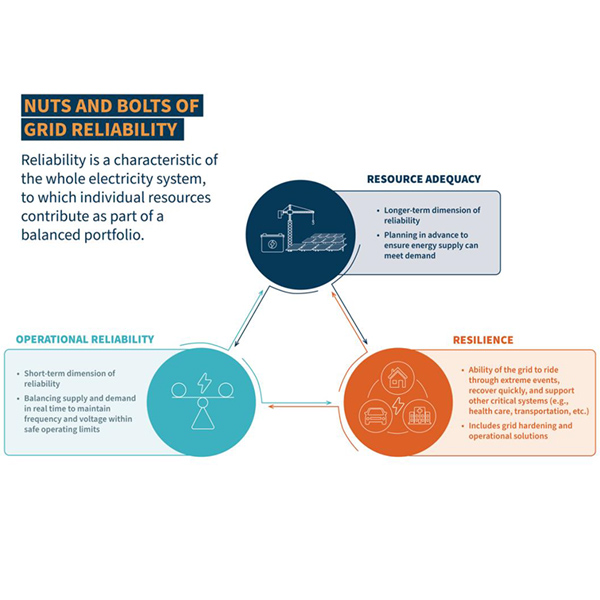

The current debate in the U.S. electricity sector pitting efforts to increase renewables against the need for grid reliability in the face of growing demand could be unnecessary and counterproductive, according to one expert.

Facing an expected surge in energy demand, New Jersey’s Board of Public Utilities outlined a draft EMP that would continue the state’s existing, vigorous electrification strategy.

In a rapid series of announcements, EPA Administrator Lee Zeldin unleashed a full-scale offensive on the agency’s regulatory authority, as it seeks to roll back as many as 31 regulations.

Want more? Advanced Search