PJM staff plan to recommend an $11.6 billion package of transmission projects intended to address rising load growth in the east of the RTO’s footprint.

PJM Director of Transmission Planning Sami Abdulsalam said the first window of the 2025 Regional Transmission Expansion Plan is one of the largest iterations of the planning process the RTO has undertaken, if not the largest. It includes constructing a greenfield 765-kV corridor from West Virginia to central Pennsylvania; an HVDC line in Virginia from Brunswick County to Loudoun County; and upgrades to the 765- and 345-kV networks around Columbus, Ohio. (See PJM Presents Shortlist of RTEP Projects.)

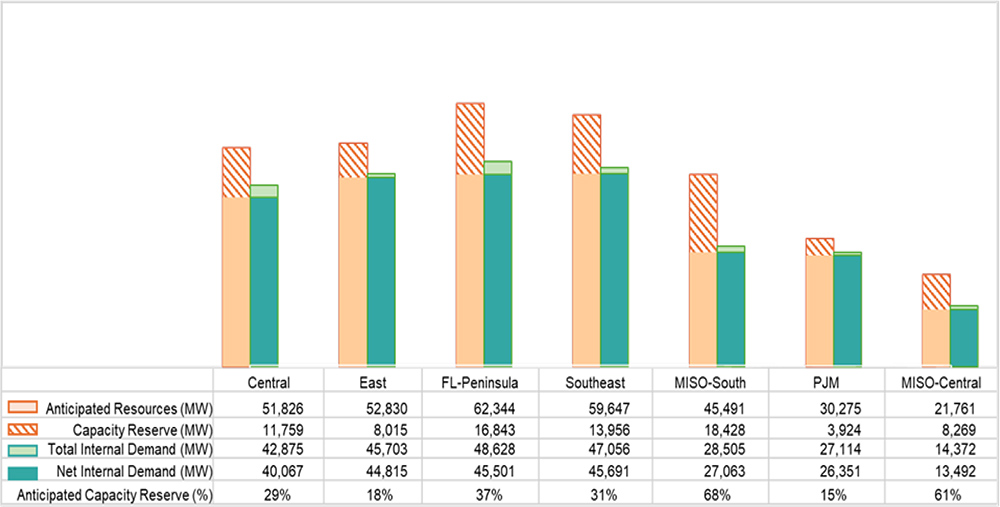

The need is being driven by 8 to 12 GW of load growth expected in the PPL and Mid-Atlantic Area Council (MAAC) regions, along with the risk of capacity resource deactivations and significant delays in offshore wind development, Abdulsalam said.

The window was broken into three clusters — west, MAAC and south — as well as $2.3 billion of in-zone projects and $18.5 million in short-circuit upgrades. Independent cost estimates procured by PJM put the total for the clusters, without the in-zone projects, at $10.2 billion.

Additional upgrades could be required along the 765-kV corridor between PJM’s northwestern region and the AEP zone, depending on how generation planned in ComEd and the northwest is constructed.

A set of seven-year scenarios was included in the analysis to right-size the projects to be able to address long-term needs and offer expandability.

Southern Cluster

The southern cluster of projects includes a new 185-mile undergrounded HVDC line between converter stations to be constructed at the Heritage and Mosby substations. It also includes a new 500-kV line between the existing Elmont substation and planned Kraken substation, and rebuilding several 500-kV lines across Dominion Energy’s territory. The package was proposed by Dominion at a $4.8 billion cost, with an independent estimate at just over $5 billion.

The cluster is intended to improve transfer capacity from the southern region of PJM up to Data Center Alley in Northern Virginia, around Dulles Airport.

Several Virginia and Maryland ratepayers spoke in support of the HVDC project on the basis that the subterranean cables would minimize disturbance to surrounding residents compared to the overhead 765-kV alternatives.

Abdulsalam said there are technical benefits to HVDC as well, as the Dominion proposal offers between 500 MW and 1 GW of additional transfer capability over the AC options, and it would not contribute to short-circuit issues that have been growing in Dominion.

The runner-up in PJM’s analysis was a $2.9 billion Transource Energy project to construct a pair of 765-kV lines, one from Heritage to Vontay and the other between Joshua Falls and Morrisville.

Western Cluster

Load growth in Columbus and to its west contributed to thermal overloads and voltage issues across the region. About 1.7 GW are expected to be added between 2029 and 2030, followed by an additional 3 GW in the subsequent two years.

PJM determined a $2.8 billion Transource project to construct several 765-kV lines around the city is the technically superior option and has an independent cost estimate $600 million lower than a joint NextEra Energy and Exelon proposal the RTO evaluated.

The package includes a 765-kV line spanning 172 miles between the Greentown and Marysville substations, with a new 765-kV substation named Teddy to be built around 35 miles west of Marysville. A 32-mile 765-kV line would be built to connect the expanded Conesville substation to the Guernsey facility, and a 38-mile 765-kV line would link the Adkins substation to West Millersport, which would also be expanded. Conesville and West Millersport would be connected with a new 49.1-mile 765-kV line.

MAAC Cluster

The need in MAAC is driven by about 5 GW of additional load growth identified in the 2025 Load Forecast expected by 2030 and delays in the development of 7.5 GW of offshore wind in New Jersey. Staff selected a $1.7 billion NextEra/Exelon proposal to construct a 222-mile, 765-kV line from the Kammer substation in West Virginia to Juniata in Pennsylvania. Two 765/500-kV substations would be built along the line: Buttermilk Falls would be 114 miles east of Kammer and loop into the 500-kV Keystone-Conemaugh line, and Mountain Stone would be constructed near Juniata.

Several stakeholders questioned whether PJM’s medium-high assessment of the land acquisition and right-of-way risks for the proposal are overly optimistic given the amount of greenfield development needed to construct the line.

Abdulsalsam said almost half of the route proposed by FirstEnergy overlaps with the NextEra/Exelon corridor, demonstrating that three entities looked at the needs and determined the ideal solution is to use the corridor. The joint proposal offers the greatest transfer capability of all the packages in the cluster.