FERC Requests Briefings on SEEM After DC Circuit Order

Clements Calls Commission’s Filing a ‘Dead End’

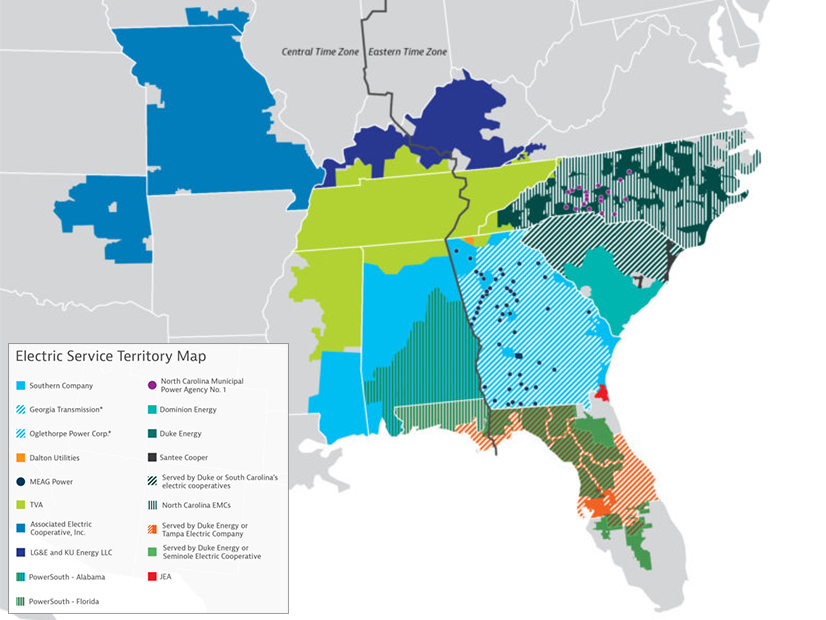

SEEM covers all or parts of 12 states following the addition of territories in Florida last year. | SEEM

Jun 17, 2024

|

FERC requested stakeholder arguments on whether SEEM should be considered a loose power pool under Order 888.