Ex-FERC Chairs Celebrate 20 Years of RTOs

Calls for Congressional Action on Anniversary of Order 2000

Jan 22, 2020

|

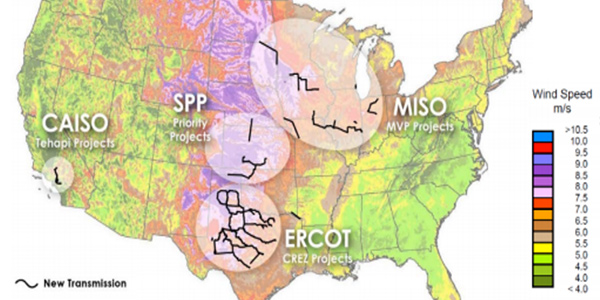

Former FERC chairs celebrated two decades of RTOs with a call on legislation to increase interregional transmission and price carbon emissions into markets.